Sage Advice During a Pandemic: Avoid Money Decisions When Emotions are High

The notes from our Zoom call with Jason Cooper of RBC Dominion Securities Inc.

From rollercoasters and Oilers’ games to trips abroad with his wife and children, Jason Cooper opens up over a Zoom call with Modern Luxuria. He’s a Wealth Advisor and Portfolio Manager with RBC Dominion Securities Inc. Cooper was born in Lamont, Alberta and grew up in Sherwood Park. As a child, he dreamed of working in the financial industry and as a man he’s been doing just that for more than 15 years. Jason Cooper gives us his top piece of advice for anyone looking to grow financially during the current pandemic and all the uncertainty it brings.

How would you describe yourself?

I identify as a father first. Now that we have three beautiful kids, I can’t imagine my life without them. Family life is so important to me. In terms of work, I really love helping people when it comes to their money. I remember when I was a little boy living in Sherwood Park, we would drive into downtown Edmonton and I would see these big financial names on the sides of these big buildings and I remember always thinking that I’m going to work there someday. The fact that I’ve not only been able to become employed by my firm but have a successful practice, it’s been like a dream come true for me.

How do you spend your leisure time?

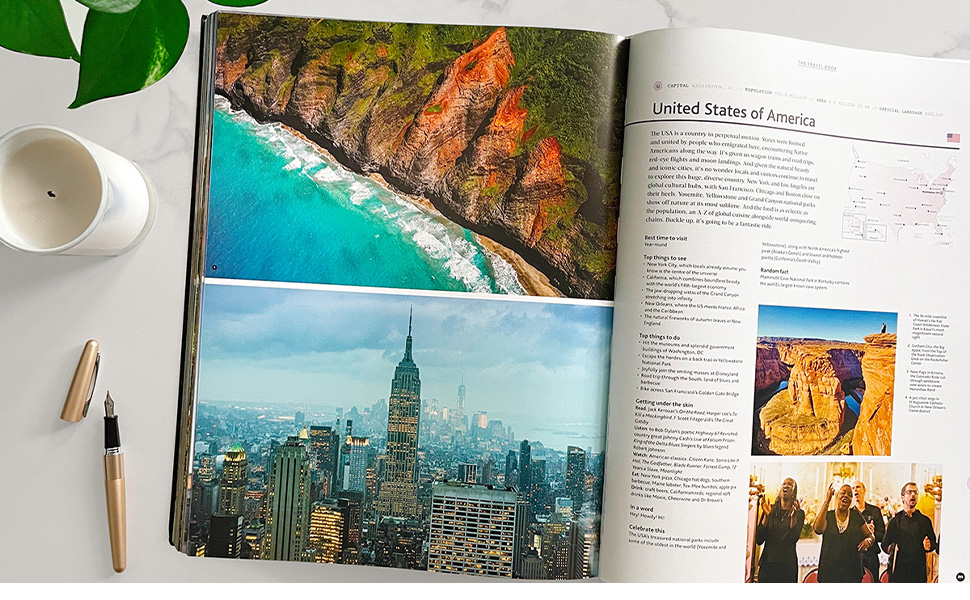

One of our biggest hobbies is travelling. I didn’t travel much as a kid. We’d go camping and we took a couple of family trips and so now I have a burning desire to travel the world. My wife and I were lucky enough to be able to do some of that. We traveled to Europe and went to Asia together. We love seeing new places and experiencing new cultures and food. We’re trying to do that with our children but, of course, this year makes it really tough. As a family, we run and stay active. Our girls are in a variety of dance classes. They have started taking skiing lessons and I’m an avid hockey fan so I’m an Oilers’ season ticket holder. I feel so great about being able to be there to support the team and take my kids to see hockey games too!

What would you say to someone who is feeling the pressure of the pandemic and its economic impact?

It’s normal to feel scared and anxious right now but I have an analogy that really affirms what many of my clients already instinctively know. What I tell them is that we’re on a rollercoaster right now. The ride has started but we’re in this together and I’m there to hold their hand. I tell them that we’re going to get to the end of the ride and it might be scary but I’m sitting beside them every step of the way and we’re going to finish this ride. I like to remind them that we’ve been through many times of market uncertainty before and we’ve always come out the other side. It might take some time but eventually we’re going to be fine.

For those who are facing a difficult present and uncertain future, what is your number one piece of advice and why?

Don’t make any rash decisions. With all the uncertainty around us, people should focus on the things they can control instead of the things they can’t. Keep long-term objectives in mind. Every time the stock market drops dramatically it is normal to be afraid and want to sell investments. Stay on course and don’t let the immediate situation cause you to make a decision you might regret later.

I identify as a father first. Now that we have three beautiful kids, I can’t imagine my life without them.

How has COVID-19 impacted your life?

We’ve had to bring the kids home for portions of 2020. My wife and I have really had to – 61 – January 2021 become more of a team to make sure we both have time to work and time to look after the kids. The downside is that it’s made for long days and we usually have to work on weekends and late into the night. The benefit of that is we’ve been able to spend some quality time together and with our girls and we’ve been able to see our young son go through all of his developments. Everyone has had to sacrifice something because of the pandemic and for us that has been getting on a plane and going on an adventure somewhere.

How have you coped during the year of lockdowns and restrictions?

When we’re having crazy days, my wife just encourages us to pause and appreciate the moment and just enjoy it because at some point down the road we’ll be back at work and we’ll definitely miss some of these moments of togetherness.

How has your industry changed during the pandemic and what do you see coming in its future?

Our business is about people and their money and I’m a face-to-face person. Up until February, it was really important to me to sit in person with my clients and the people we do business with. It’s how I built rapport and strengthened my relationships and the minute we couldn’t do that anymore, I felt very stranded and insecure about how I might communicate with people. The one thing I’ve realized is that the gravity of the situation we’re in has allowed people to really open up over the phone and through mediums like Zoom. We can have as good or better conversations online as we did face-to-face. I think that now that we’ve experienced that, and we understand that, our industry will really embrace over-the-phone and internet communication, even after the pandemic is over.

What are the benefits of working with a Portfolio Manager and Wealth Advisor?

Our clients appreciate leaning on myself and my team’s experience to manage their wealth so they can focus their time and energy on their work, their family and the activities they are passionate about. Working with a Wealth professional such as myself delegates the details to us. We help a client establish goals and objectives, consider stumbling blocks that may hamper those goals and focus on ways to optimize their situation. People can be emotional about their money so my team and I provide objectivity and a disciplined approach. What areas of the market to invest in, how to plan for income in retirement and the tax implications of various investment strategies are just some of the things we provide guidance on. Our clients have worked hard over their lifetimes and my job is to make sure their money is working hard for them.

Places To Be

See this month's local flavours, products, and services.